SaveOurFarms: Difference between revisions

No edit summary |

No edit summary |

||

| (4 intermediate revisions by the same user not shown) | |||

| Line 3: | Line 3: | ||

|title=SaveOurFarms | |title=SaveOurFarms | ||

|titlemode=replace | |titlemode=replace | ||

|keywords=#saveourfarms | |keywords=#saveourfarms #jeremyclarkson #farmingtax #farmprotest #lovefarmers #londonfarmprotest | ||

|hashtagrev=12032020 | |hashtagrev=12032020 | ||

|description=Save Our Farms End The UK Labour government’s proposed changes to inheritance tax on family farmland | |description=Save Our Farms End The UK Labour government’s proposed changes to inheritance tax on family farmland | ||

| Line 13: | Line 13: | ||

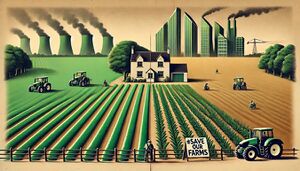

===Save Our Farms=== | ===Save Our Farms=== | ||

The UK Labour government’s proposed changes to inheritance tax on agricultural property, specifically adjustments to Agricultural Property Relief (APR), are sparking strong opposition from farmers and rural advocates. | The UK Labour government’s [''well, actually Rachel from Accounts''] proposed changes to inheritance tax on agricultural property, specifically adjustments to Agricultural Property Relief (APR), are sparking strong opposition from farmers and rural advocates. | ||

The proposed policy seeks to address budgetary deficits, but critics argue that without APR, family farms with narrow profit margins might struggle to survive. Farmers rely on APR to preserve multi-generational farms, and they see any reduction in these tax reliefs as potentially devastating to both the farming community and the wider rural economy. Many are calling on the government to protect inheritance tax relief for agriculture to sustain rural livelihoods and the long-term viability of family farms. | The proposed policy seeks to address budgetary deficits, but critics argue that without APR, family farms with narrow profit margins might struggle to survive. Farmers rely on APR to preserve multi-generational farms, and they see any reduction in these tax reliefs as potentially devastating to both the farming community and the wider rural economy. Many are calling on the government to protect inheritance tax relief for agriculture to sustain rural livelihoods and the long-term viability of family farms. | ||

| Line 43: | Line 43: | ||

* Above article content courtesy of [https://conservativepost.co.uk/ conservativepost.co.uk] | * Above article content courtesy of [https://conservativepost.co.uk/ conservativepost.co.uk] | ||

===Jeremy Clarkson attending protest=== | |||

According to [https://www.farmersguardian.com/news/4378366/clarkson-seeks-generation-farmer-lead-family-farm-tax-protest Farmer's Guardian], Jeremy Clarkson says he will be attending next week's London protest against Labour's Farm Inheritance Tax. 😃 | |||

{{CategoryLine}} | {{CategoryLine}} | ||

[[Category:Useful information]] | [[Category:Useful information]] | ||

<!-- footer hashtags --><code 'hashtagrev:12032020'>#saveourfarms</code><!-- /footer_hashtags --> | <!-- footer hashtags --><code 'hashtagrev:12032020'>#saveourfarms #jeremyclarkson #farmingtax #farmprotest #lovefarmers #londonfarmerprotest</code><!-- /footer_hashtags --> | ||

Latest revision as of 16:57, 20 November 2024

Save Our Farms

The UK Labour government’s [well, actually Rachel from Accounts] proposed changes to inheritance tax on agricultural property, specifically adjustments to Agricultural Property Relief (APR), are sparking strong opposition from farmers and rural advocates.

The proposed policy seeks to address budgetary deficits, but critics argue that without APR, family farms with narrow profit margins might struggle to survive. Farmers rely on APR to preserve multi-generational farms, and they see any reduction in these tax reliefs as potentially devastating to both the farming community and the wider rural economy. Many are calling on the government to protect inheritance tax relief for agriculture to sustain rural livelihoods and the long-term viability of family farms.

#SaveOurFarms has become widely used across social media, representing the concerns that scaling back APR could force farming families to sell portions of their land to cover tax obligations. This shift would pose a threat not only to rural heritage but also to the nation’s food security.

Do everything you can to help repeal this wicked, thoughtless tax before our farming heritage is destroyed for good.

Britain’s Farmers to Flock to Westminster in Furious Revolt Against Labour’s ‘Family Farm Tax’

Organised by the National Farmers’ Union (NFU), the ‘mass lobby of MPs’ will take place at Church House conference centre in Westminster on Tuesday, 19 November.

Farmers have blasted Chancellor Rachel Reeves’ sweeping tax changes to agricultural property relief (APR) and business property relief (BPR), with the NFU slamming the budget as a “hammer blow” to Britain’s farming families. Faced with razor-thin margins, surging inflation, bad weather, and escalating production costs, many farmers are “at breaking point” and “simply unable to absorb any more costs,” the NFU warns.

NFU President Tom Bradshaw didn’t mince words. “Farmers have been left reeling from these changes, which show a fundamental lack of understanding of British agriculture. The government’s claims that only one in four farms will be affected are wildly misleading,” he said. “We’re talking about viable farms where asset value does not reflect the actual income, which is often low and getting lower. The Chancellor’s savings from these tax changes come directly from the next generation being forced to break up their family farms. It simply mustn’t happen.”

The government’s new APR and BPR policies, set to take effect in April 2026, mean that the current 100% rate of relief will only apply to the first £1 million of combined agricultural and business assets, dropping to 50% for anything above this threshold. It’s a reform the NFU says will see farmers crippled by inheritance taxes that were supposedly safe under the current rules. Furthermore, Labour’s decision to accelerate the phaseout of direct payments will mean no farm will receive more than £8,000 by 2025, a cut of over 90% in some cases.

British farmers, already stretched to breaking point, now face the brutal blow of a 6.7% increase to the National Living Wage, bringing it up to £12.21, alongside a 16.3% hike in the National Minimum Wage for young workers. For rural communities struggling to survive, these costs spell disaster.

In a move that’s stirred further outrage, Labour has chosen to freeze the agricultural budget at 2014 levels, ignoring years of calls from farmers for a budget that reflects modern costs and challenges.

“Farmers are rightly angry and concerned about their future and the future of their family farms,” Mr. Bradshaw stated.

One farmer who has already said he will attend the protest told the Conservative Post: “At the London rally, we’ll be asking MPs to look their constituents in the eye and tell them whether they support these punitive measures. It’s vital MPs understand the consequences of these actions, which is why we’re mobilising members to meet them face-to-face. The government still has time to backtrack, and I urge ministers to rethink this ‘family farm tax’ and do what’s right.”

The NFU, who represent 70% of farmers across England and Wales, has called upon its 23,000-strong membership to stand united in Church House, London on 19 November.

The message from Britain’s farmers to the government is loud and clear: take heed of this rallying cry or risk the livelihoods of British farmers and the future of family farms across the nation.

More details to be released by the NFU at www.nfuonline.com

- Above article content courtesy of conservativepost.co.uk

Jeremy Clarkson attending protest

According to Farmer's Guardian, Jeremy Clarkson says he will be attending next week's London protest against Labour's Farm Inheritance Tax. 😃

#saveourfarms #jeremyclarkson #farmingtax #farmprotest #lovefarmers #londonfarmerprotest